Gain Institutional-Level Precision with Mastering VWAP – Instant Download!

Trading with confidence starts with clarity — and Mastering VWAP: X-Ray Vision for Precision Profits (557 MB, $53.9) by Verified Investing gives you that advantage.

This course reveals how professional traders and hedge funds use VWAP (Volume Weighted Average Price) to make decisions that are data-driven, not emotional.

Designed by Doctor B., this program teaches you how to combine VWAP analysis with his proven 1-Minute Scalpel Method to achieve surgical precision in your trades. If you’ve ever wondered how institutions time their entries perfectly, this is where you’ll learn their secrets.

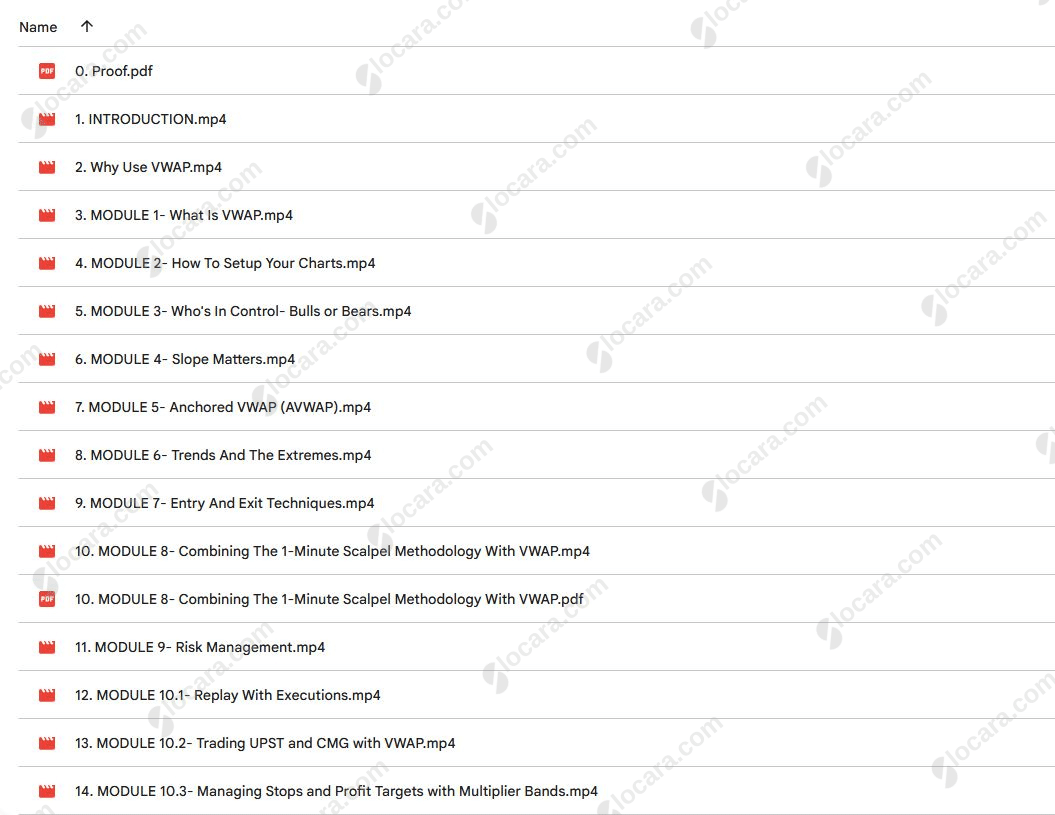

Free Download the Mastering VWAP: X-Ray Vision for Precision Profits – Includes Verified Content:

Mastering VWAP: X-Ray Vision for Precision Profits – Free Download Video Sample:

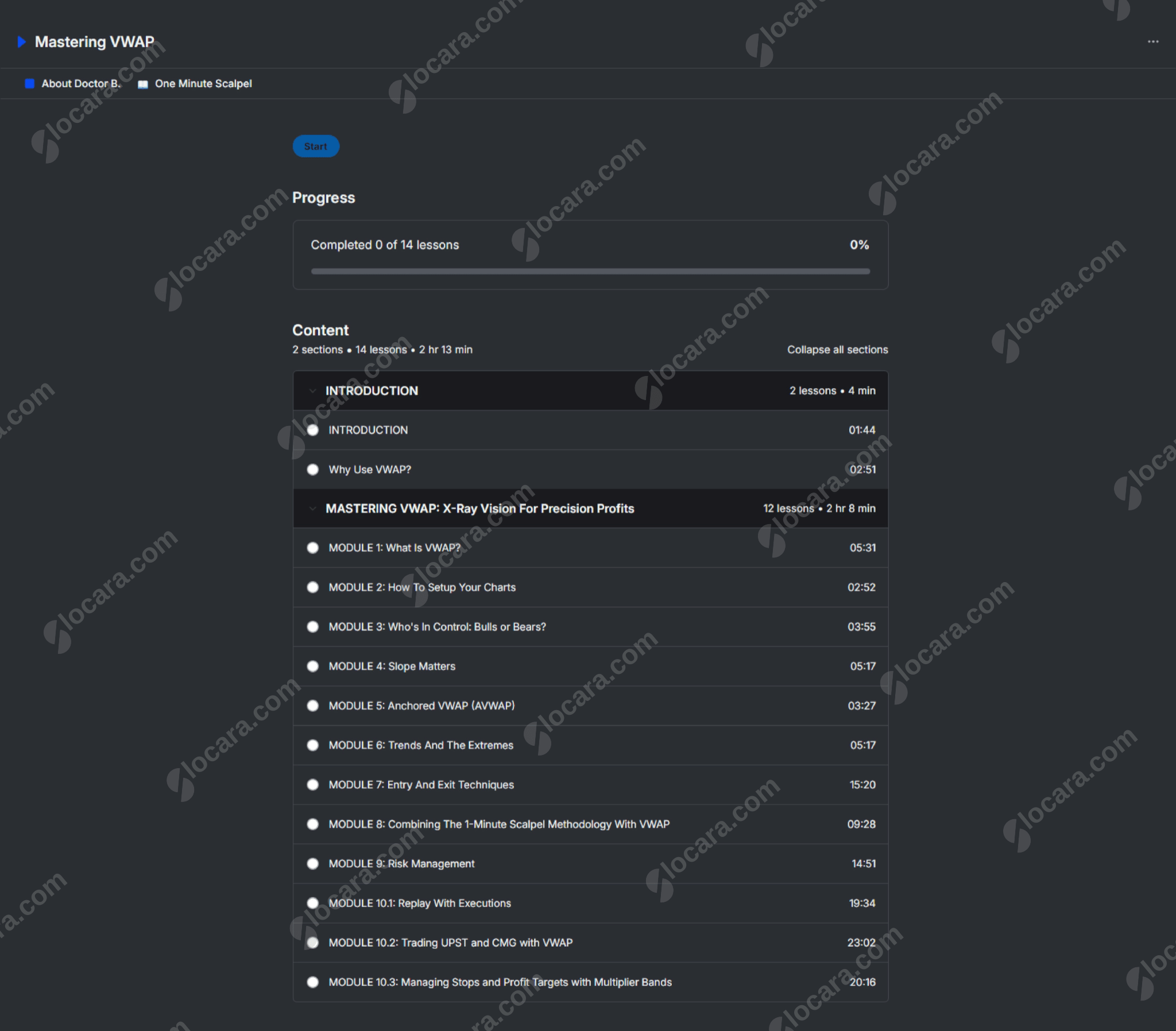

Mastering VWAP: X-Ray Vision for Precision Profits – Watch Content Proof here:

Understand the Core – What Makes VWAP So Powerful

VWAP isn’t just another indicator — it’s the backbone of institutional trading.

In Mastering VWAP, you’ll learn why large players rely on this metric to gauge market sentiment, identify value zones, and plan execution.

By understanding VWAP, you can:

- Detect where institutional traders are buying and selling.

- Recognize trend continuation or reversal signals early.

- Identify when price is overextended and due for correction.

- Align your entries with smart money, not against it.

VWAP gives you the “x-ray vision” to see beneath surface price action and trade with clarity.

Course Breakdown – A Clear Roadmap to Precision

This program consists of 10 structured modules designed to build mastery step by step. Each lesson includes real examples, chart setups, and guided practice.

Module 1: Introduction to Mastering VWAP

Understand what VWAP is, why institutions depend on it, and how it transforms your chart reading and trade timing.

Module 2: Setting Up Your Charts

Get a detailed walkthrough on applying VWAP across different timeframes and platforms. Learn optimal configurations for accuracy and readability.

Module 3: Bulls vs. Bears

Use VWAP to determine who’s in control of the market. Doctor B. shows you how to read the balance between buyers and sellers at a glance.

Module 4: Slope Matters

Learn how the slope of VWAP indicates market strength. Up-sloping VWAP suggests demand, down-sloping signals weakness — and horizontal VWAP defines balance zones.

Module 5: Anchored VWAP

Discover how to use Anchored VWAP to capture precise entries and exits. You’ll learn to anchor from significant highs or lows to track market memory effectively.

Module 6: Trends and Extremes

Explore how VWAP interacts with trending markets and extreme conditions, helping you avoid traps and trade only in high-probability zones.

Module 7: Entry and Exit Techniques

Master the art of timing. Learn how to buy strength, short weakness, and execute flawless exits using VWAP confluence and Doctor B.’s rule-based system.

Module 8: The 1-Minute Scalpel Method

Combine VWAP with the 1-Minute Scalpel for precision trading. Watch real-time demonstrations of multi-factor setups that give you surgical entries.

Module 9: Risk Management

No strategy is complete without control. Learn Doctor B.’s proven methods to size positions, manage stops, and let winners run while limiting losses.

Module 10: Replay with Executions

See the entire system in action. Watch Doctor B. replay recent trades, explaining how VWAP guided his decision-making in live conditions.

The Institutional Strategy Unlocked

Most traders rely on basic indicators. Institutions rely on VWAP because it shows where money truly flows.

This course bridges that gap — giving you the tools to interpret institutional footprints and trade alongside them, not against them.

You’ll learn how to:

- Identify accumulation and distribution phases.

- Spot traps and fakeouts before they trigger.

- Combine VWAP with volume and price action for maximum precision.

These are the same principles that drive high-frequency algorithms and fund-level trading desks.

Why Traders Love the VWAP Approach

VWAP trading isn’t about predicting the market; it’s about aligning with reality.

With Mastering VWAP, you’ll stop reacting to every candle and start reading the story behind the market.

This method helps you:

- Enter with confidence, not hesitation.

- Stay patient during consolidation.

- Exit trades methodically based on structure, not emotion.

It’s precision trading at its best — clear, logical, and repeatable.

Combine VWAP with the 1-Minute Scalpel for Maximum Edge

Doctor B.’s 1-Minute Scalpel Methodology complements VWAP perfectly.

You’ll see how to apply short-term execution tactics within institutional frameworks, enabling fast, confident trades that align with larger market trends.

This hybrid method teaches you when to strike, when to wait, and how to manage your trades minute-by-minute without losing the big picture.

Who This Course Is For

Mastering VWAP is ideal for:

- New and intermediate traders who want structure and clarity.

- Investors aiming to understand institutional behavior.

- Anyone tired of emotional trading and ready for a proven, rule-based system.

If you want to improve your precision, timing, and risk control, this course delivers practical tools for lasting consistency.

Start Trading with X-Ray Precision

Precision isn’t luck — it’s skill built through structure.

With Mastering VWAP (557 MB, $53.9), you’ll gain the insight, confidence, and technical control to trade with the same clarity as institutional professionals.

Ready to see the market through new eyes?

🎯 Discover more professional trading programs here

Reviews

There are no reviews yet.