ATR Reversion Course by Scott Pulcini – Instant Download!

Trading the Reversion: The Hidden Edge of Market Flow

Behind every flash of volatility lies structure.

The ATR Reversion Course by Scott Pulcini reveals how elite traders profit not from prediction—but from reaction.

This 651 MB masterclass (priced at $193.9) distills the real trading approach used inside a Chicago proprietary firm, teaching you how to scalp with precision and align with algorithmic order flow instead of fighting against it.

It’s not just another strategy course—it’s a roadmap to reading the pulse of the market.

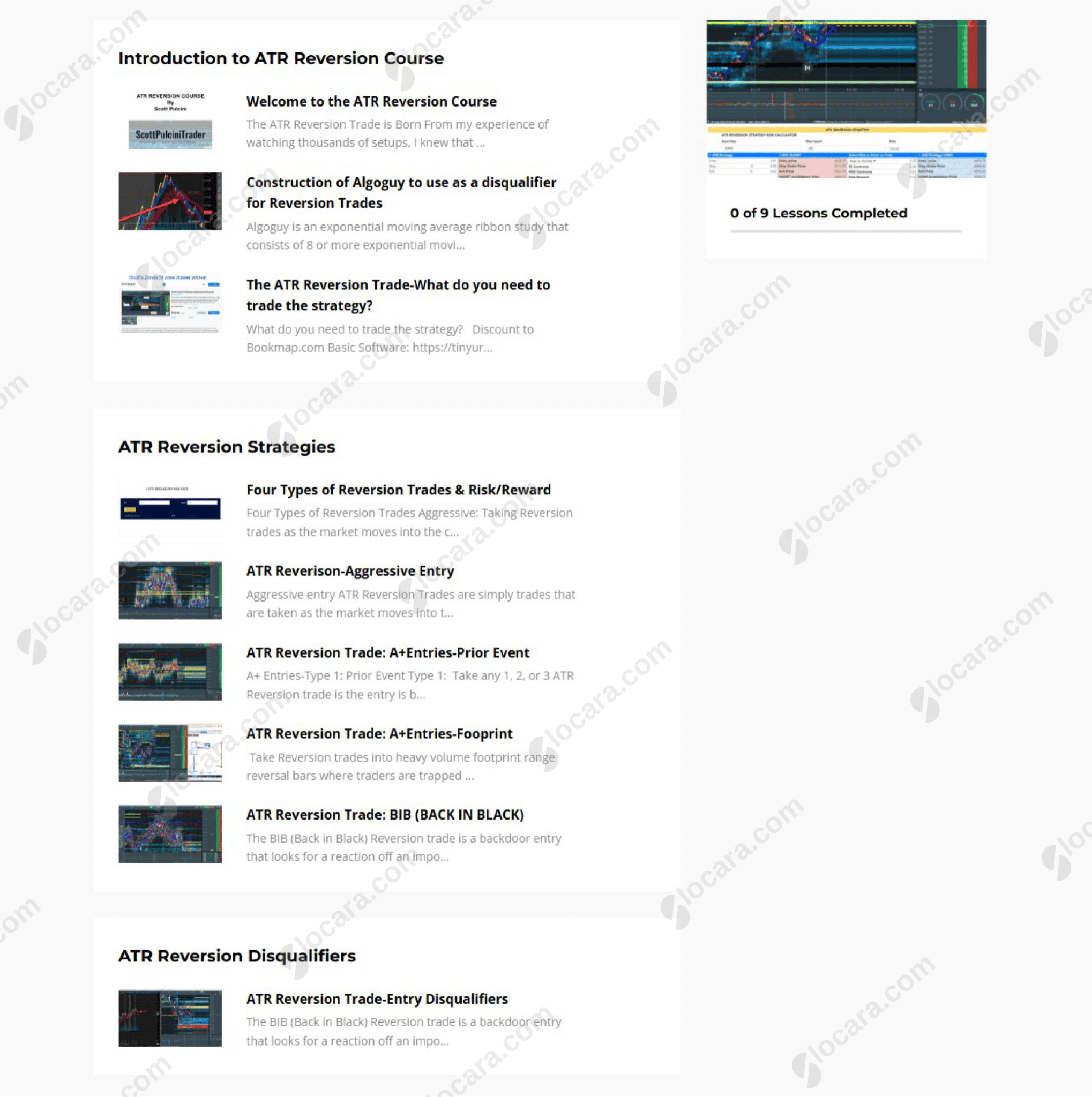

Free Download the ATR Reversion Course by Scott Pulcini – Includes Verified Content:

ATR Reversion Course – Free Download Video Sample:

PDF Sample – ATR Reversion Course, watch here:

ATR Reversion Course – Watch Content Proof here:

Inside the Mind of a Market Veteran

Scott Pulcini isn’t your average trading educator.

He’s one of the few traders who have lived through the intensity of institutional-level order flow, handling thousands of contracts in milliseconds and surviving markets where mistakes cost fortunes.

In the ATR Reversion Course, Scott breaks down his decades of experience into a clear, adaptable framework that transforms the way you perceive price action.

You’ll discover why the most consistent profits often come not from trend-chasing—but from disciplined reaction to reversion points.

This is trading the way professionals see it: structured, data-driven, and ruthlessly efficient.

Understanding the ATR Reversion Concept

At its core, ATR Reversion is about mean reversion—the natural tendency of markets to pull back toward balance after an impulse move.

But Scott’s version takes it further.

By incorporating SI (Stop/Iceberg) events and algorithmic reaction zones, this system capitalizes on short-term volatility whipsaws—where most retail traders get trapped, but professionals quietly profit.

Instead of being hunted by algos, you’ll trade with them.

The strategy identifies exhaustion points, filters false momentum, and provides precise re-entry signals aligned with institutional behavior.

Every setup is grounded in logic, not speculation.

The Core of the System: Four Proven ATR Strategies

Scott’s course delivers four distinct ATR Reversion setups, each crafted for specific market structures and volatility conditions.

You’ll learn when and how to apply them—filtering out noise and focusing on repeatable edge.

1. The Standard ATR Snapback

This foundational play takes advantage of overextended price moves. When ATR spikes and market depth thins, this setup identifies exhaustion candles ripe for reversal.

2. The SI Fade

Markets often overreact to Stop/Iceberg triggers. This strategy teaches you to fade those extremes with precision—using liquidity footprints to catch the “second wave” reaction.

3. The Algo Sync Setup

A dynamic approach that aligns your entries with algorithmic behavior. Instead of opposing the bots, you scalp with their rhythm—identifying zones of automated buying/selling pressure.

4. The Disqualification Reversal

Not every setup deserves a trade. This module shows how to eliminate low-probability conditions instantly, keeping your capital focused where the math is on your side.

Each play is dissected step-by-step with chart visuals, execution notes, and trade psychology cues.

These aren’t theory slides—they’re the same setups Scott automates in live environments.

Trading with the Machines, Not Against Them

One of the biggest challenges for modern traders is adapting to algorithmic volatility.

While retail traders react emotionally, institutional algorithms follow strict logic. The ATR Reversion Course flips this disadvantage—teaching you to surf the same waves that move markets.

You’ll understand:

-

How to recognize SI events before they fully unfold

-

How whipsaw algos create liquidity traps

-

How to time entries during post-event reversions

-

And how to scalp with the flow, not against it

This is how pros avoid getting caught in “fake breakouts” and instead profit from the inevitable snap back.

Beyond Strategy: The Discipline Behind the Trade

Scott’s philosophy is simple: no trade is better than a bad trade.

That’s why this course goes beyond charts—teaching decision hierarchy, disqualifiers, and context recognition.

You’ll master when not to trade:

-

ATR thresholds that signal “noise zones”

-

Momentum conditions that invalidate reversions

-

Emotional triggers that lead to overtrading

This systematic approach ensures that your capital is always protected—and deployed only when market conditions truly align.

The result? Fewer trades. Higher accuracy. Sustainable profitability.

The Tools You’ll Need for Success

Scott keeps it practical. You’ll receive detailed guidance on how to replicate his trading environment.

That includes:

-

Recommended ATR indicators and volatility parameters

-

Chart setups optimized for SI/Order Flow visibility

-

Data feed and platform suggestions for real-time execution

-

Access to advanced filters and risk parameters used in his proprietary system

Each component is tested, streamlined, and field-proven.

The goal is simple: trade what works, not what’s trending.

Who This Course Is For

This course is designed for traders who demand precision and consistency—not noise and luck.

It’s perfect for:

-

Active scalpers who trade fast-moving futures or equities.

-

Algorithm-aware traders who want to integrate systematic logic into their setups.

-

Professional and aspiring prop traders seeking institutional-level insight.

-

Retail traders ready to move beyond “indicators” and into pure price behavior.

It’s not for gamblers, impulsive traders, or those unwilling to follow structure.

Scott’s approach requires patience, analysis, and emotional control—the real edge in modern markets.

Meet the Architect: Scott Pulcini

A name synonymous with precision and professionalism, Scott Pulcini has spent decades trading order flow across equities and futures.

As a former proprietary trader in Chicago, he’s known for his expertise in microstructure analysis and SI event dynamics.

His reputation was built not on flashy promises, but on verifiable results. Thousands of traders have followed his teachings, adopting his methods to bring discipline, structure, and data-based clarity to their trading decisions.

In the ATR Reversion Course, Scott distills that legacy into a practical, replicable system—one that gives everyday traders access to professional-grade logic.

The Value of Mastery

For $193.9, you gain lifetime access to a 651 MB course that bridges the gap between theory and execution.

This isn’t a signal group or “one-size-fits-all” system—it’s the foundation of algorithmic literacy for real traders.

By mastering the ATR Reversion strategies, you’ll:

-

Anticipate institutional moves before retail traders react

-

Identify high-probability zones and execute with clarity

-

Protect your account by avoiding false setups

-

Align your trading mindset with measurable, repeatable logic

This is trading redefined—where data meets intuition, and skill replaces hope.

Ready to stop guessing and start executing like a professional?

Join Scott Pulcini’s ATR Reversion Course on Glocara today and start trading with confidence, precision, and purpose.

Reviews

There are no reviews yet.