AI For Traders: A Professional Manual for Hedge‑Fund‑Level Alpha by Laurence Connors – Instant Download!

Overview

What if the most powerful source of alpha today isn’t hidden in a new factor, a secret dataset, or a faster colo—but in the way you think with AI? AI For Traders: A Professional Manual for Hedge-Fund-Level Alpha by Laurence (Larry) Connors is a complete, professional playbook that shows you how to engineer “Cognitive Analysis”—the fusion of your market expertise with AI’s massive market memory—to consistently uncover tradable edges.

Delivered as a 1.37 GB resource including a 7-hour Master Class, the manual condenses decades of institutional trading know-how into practical workflows, prompt blueprints, and repeatable processes. Priced at $93.1, it’s designed for traders who want hedge-fund-level rigor without hedge-fund-level overhead.

You’ll learn how to move from broad, noisy AI chats to sharp, data-dense answers you can trade on—strategy by strategy, trade by trade.

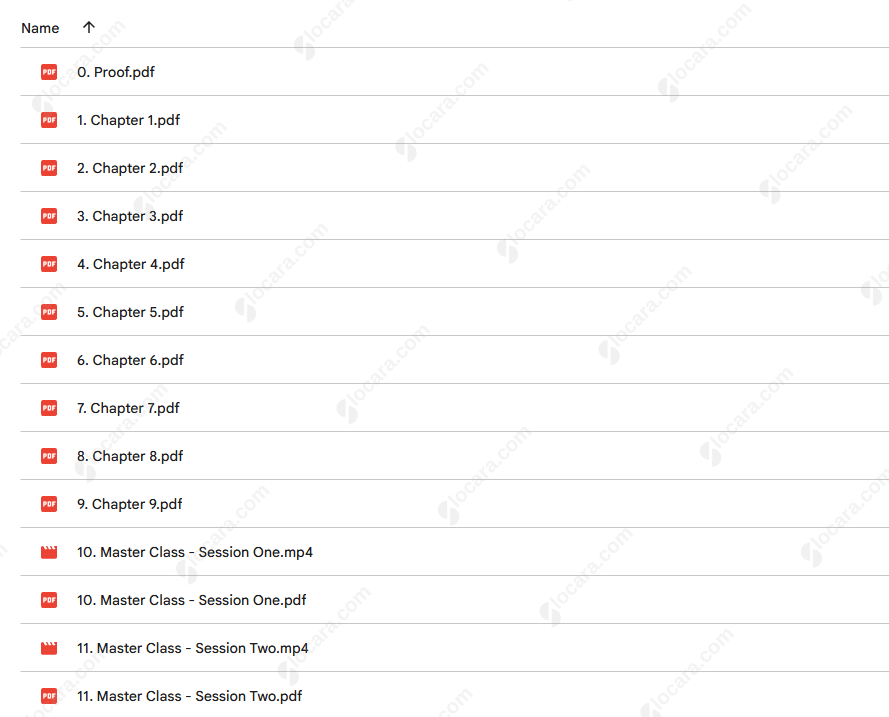

Free Download the AI For Traders: A Professional Manual for Hedge‑Fund‑Level Alpha – Includes Verified Content:

PDF Sample – AI For Traders: A Professional Manual for Hedge‑Fund‑Level Alpha, watch here:

AI For Traders: A Professional Manual for Hedge‑Fund‑Level Alpha – Watch Content Proof here:

Why it matters

Most professionals aren’t beating the market, and it’s not for lack of intelligence or effort. The edge in traditional Fundamental, Technical, and even Quantitative analysis has been largely arbitraged away. That’s why so many funds lag benchmarks and why common playbooks produce only basis points of advantage.

Cognitive Analysis changes the game. Instead of hoping for an edge from yesterday’s tools, you harness AI as an institutional co-analyst:

-

Compress weeks of research into minutes.

-

Illuminate second- and third-order effects that first-order models miss.

-

Systematize professional prompting so insights arrive clear, defensible, and trade-ready.

The result is a durable process for finding genuine, repeatable alpha in a market where traditional signals are crowded and slow.

Benefits you can expect

-

Hedge-fund clarity on demand – A three-step prompting blueprint pulls precise stats, risks, catalysts, and setups without rewrites or noise.

-

Time-arbitrage advantage – Complete in 20 minutes what used to take teams six weeks, getting to trades while the market is still reacting.

-

Higher-order thinking – Structured frameworks for second- and third-order cause-and-effect analysis reveal early price shifts across sectors and timeframes.

-

Repeatable strategy construction – Turn headlines, footnotes, and “one-line” ideas into fully specified, testable strategies.

-

Portfolio-level scalability – Clone the same workflow across symbols, asset classes, and team members for firm-wide consistency.

-

Behavioral resilience – AI-assisted trading psychology protocols help you stick with proven edges when emotions spike.

-

Rapid skill compounding – CALC (Cognitive Analysis Learning Center) personalizes learning so you level up in hours, not months.

What you’ll learn

-

Why AI is the largest reservoir of alpha in market history—and how to ethically exploit information asymmetries.

-

The Cognitive Analysis framework—a rigorous method that fuses trader intuition with AI’s memory to surface mispricings earlier.

-

Professional-level prompting—the exact language patterns that deliver concise, data-rich answers suitable for decision-making.

-

Prompt amplifiers—short “power phrases” that multiply the precision and usefulness of any AI response.

-

Strategy engineering—from idea extraction to documented rules, including examples that anticipated trends like quantum computing.

-

Daily execution—a 15-minute routine that embeds Cognitive Analysis into your workflow so it becomes muscle memory.

-

Performance psychology—AI-optimized coaching loops to reduce drawdown panic, prevent strategy drift, and reinforce discipline.

Key features & modules

Chapter 1 — AI Holds the Greatest Amount of Alpha in History

-

Hedge-Fund Speed, Solo Operator: Replace analyst armies with a 20-minute AI workflow.

-

Clear Alpha Map: Understand where legacy FA/TA/QA edges disappeared—and where AI-powered edges now reside.

-

Actionable Exercise: Run the workflow on your three largest positions tonight to produce a ranked, trade-ready improvement list by the open.

Chapter 2 — Cognitive Analysis: The Fourth & Final Frontier

-

Edge-Migration Map: See how speed, crowding, and HFT drained traditional edges, and how alpha re-emerged within AI-driven reasoning.

-

Reallocation Blueprint: Shift time and capital from obsolete screens into Cognitive Analysis to start compounding new edges immediately.

-

Practical Swap: Retire a weak FA/TA/QA screen tonight and re-run it using CA tomorrow.

Chapter 3 — How to Think for Alpha

-

Second- & Third-Order Thinking: Learn the checklist that converts headlines into cross-sector and cross-timeframe trades.

-

Live Walk-Through: From event to construction—mirror a full CA process the same day.

-

Homework: Apply the 3-question filter to tonight’s news; surface asymmetric trades.

Chapter 4 — Professional-Level Prompting (Three-Step Blueprint)

-

Ask once, get clarity: The core prompt structure that pulls risks, scenarios, and evidence in one pass.

-

Research compression: Replace hours of manual digging with a single dialog.

-

Team-Ready: Hand the sheet to any analyst; watch quality snap to pro standards.

Chapter 5 — Five Prompt Amplifiers

-

Power Phrases: Field-tested language that locks the model onto what matters—data, drivers, and trade construction.

-

80% faster extraction: Convert vague questions into structured, trade-ready frameworks in seconds.

-

Universal: Works across asset classes, timeframes, and research tasks.

Chapter 6 — Turning Cognitive Analysis into Repeatable Trading Alpha

-

From narrative to rules: Examples include early identification of quantum computing leaders (e.g., QBTS, IONQ), a leveraged ETF strategy from a single sentence, and stock lists derived from subtle behavioral shifts.

-

Reverse-engineering: Derive institutional methods from world-class investor letters and convert them into practical playbooks.

Chapter 7 — Compressing Weeks of Learning into Hours (CALC)

-

Adaptive curriculum: CALC tailors difficulty and depth, quizzing and amplifying to speed mastery.

-

Live scenario training: Spin breaking news into professional playbooks in real time.

Chapter 8 — Trading Psychology Optimized by AI

-

48-question assessment: Map strengths, weaknesses, and risk tolerance.

-

Behavioral blueprint: Hard-wire protocols to withstand volatility and protect capital.

-

On-demand coaching: Channel the wisdom of top trading psychologists into actionable routines.

Chapter 9 — Embedding CA into Your Daily Workflow

-

15-minute closeout: A short checklist to lock in learning and prepare next-day action.

-

Team scalability: Clone the process across desks for consistent, defensible decision-making.

-

Durable information advantage: Built-in update cycles keep prompts and datasets fresh.

Bonus — Larry Connors’ 7-Hour Master Class

-

Immediate access: A private, extended training that reinforces the manual with proprietary strategies, hedge-fund frameworks, and ready-to-use prompts.

Who it’s for

-

Professional and prop traders who need a scalable, defensible process for alpha discovery.

-

Hedge-fund analysts & PMs seeking to compress research cycles and standardize institutional prompting across the desk.

-

Systematic and discretionary traders who want to translate narrative, news, and behavior into rule-based strategies.

-

Advanced retail traders ready to adopt professional workflows without enterprise complexity or cost.

-

Team leads who want repeatability—identical high-quality outputs regardless of who runs the workflow.

How you’ll work, day to day

-

Run the 20-minute CA scan after the close on your top holdings to identify mispricings before the open.

-

Use the three-step prompt to extract concise, decision-grade insights: drivers, scenarios, risks, and setups.

-

Apply one prompt amplifier to tighten outputs—turning an idea into a ranked list of trades with clear entry/exit logic.

-

Stress-test psychology protocols to avoid strategy abandonment during volatility.

-

Document strategy variants (timeframes, hedges, filters) for portfolio-level deployment.

-

Review with the 15-minute checklist so the process becomes automatic and scalable.

Proof-of-concept examples included in the manual

-

Early trend capture: CA highlighted rising power demand from AI (including nuclear) before it became consensus—an example of second-order reasoning leading to sector allocation advantages.

-

Foresight on quantum computing: CA recognized QBTS and IONQ as likely long-term winners when the Street still saw commercialization as far off.

-

From one sentence to a system: How a single line in a respected trading book became an actionable, rules-based leveraged ETF strategy.

-

Turning micro-signals into trades: Convert short WSJ blurbs and search-behavior shifts into targetable stock baskets.

-

Reverse-engineering legends: Translate the strategic DNA of top investors (e.g., Seth Klarman) into step-by-step, testable playbooks.

Important note: Markets involve risk. The manual provides professional frameworks and examples—it does not guarantee returns. Always validate, size appropriately, and follow your risk protocols.

What sets Larry Connors apart

Larry Connors has spent 44 years on the professional trading front lines, shaping modern short-term trading with statistically grounded research. From the 1990s mean-reversion studies to early insights on VIX behavior and practical adaptations of RSI (2- and 4-period signals), his work is widely referenced by institutional desks. He’s authored 14 trading books, earned the Charles H. Dow Award for original research, taught managers to design institution-grade AI strategies, and founded TradingMarkets and Connors Research.

This manual is the culmination of that lineage—updated for the AI era.

What’s inside the download

-

Format & size: Digital package, 1.37 GB.

-

Contents: The core manual, prompt blueprints, checklists, the CALC learning engine workflow, and the 7-hour Master Class.

-

Price: $93.1 (single purchase access).

-

Use cases: Equity, ETF, derivatives, cross-asset screening; discretionary and systematic styles.

Ready to operate at hedge-fund speed?

If you’re serious about extracting alpha in a market where traditional edges are saturated, AI For Traders is your execution guide. In the first evening, you can run the Chapter-1 workflow on your top symbols, turn headlines into second- and third-order trades using Chapter-3, and use the Three-Step Blueprint from Chapter-4 to generate a clean, tradable brief—all in under an hour.

Get instant access now to the 1.37 GB package and the 7-hour Master Class for $93.1. Start building repeatable, hedge-fund-grade alpha tonight—while everyone else is still reading about it.

Reviews

There are no reviews yet.