Kill Zones Mastery – Trade When Smart Money Moves by Finastic – Instant Download!

Trade Smarter, Not Longer

Most traders spend all day in front of charts — yet only a few make consistent profits. Why? Because smart traders know when to trade.

Kill Zones Mastery – Trade When Smart Money Moves by Finastic is a concise yet powerful guide that reveals the exact timing model institutions use to manipulate price, sweep retail liquidity, and create the true directional move.

At just 21 MB and $15.4, this PDF manual cuts through the noise, giving you the precise timing windows, liquidity patterns, and market structure insights that separate amateurs from professionals.

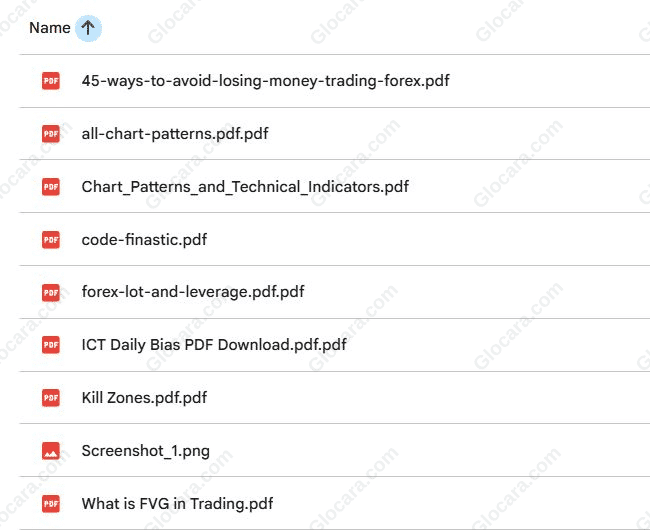

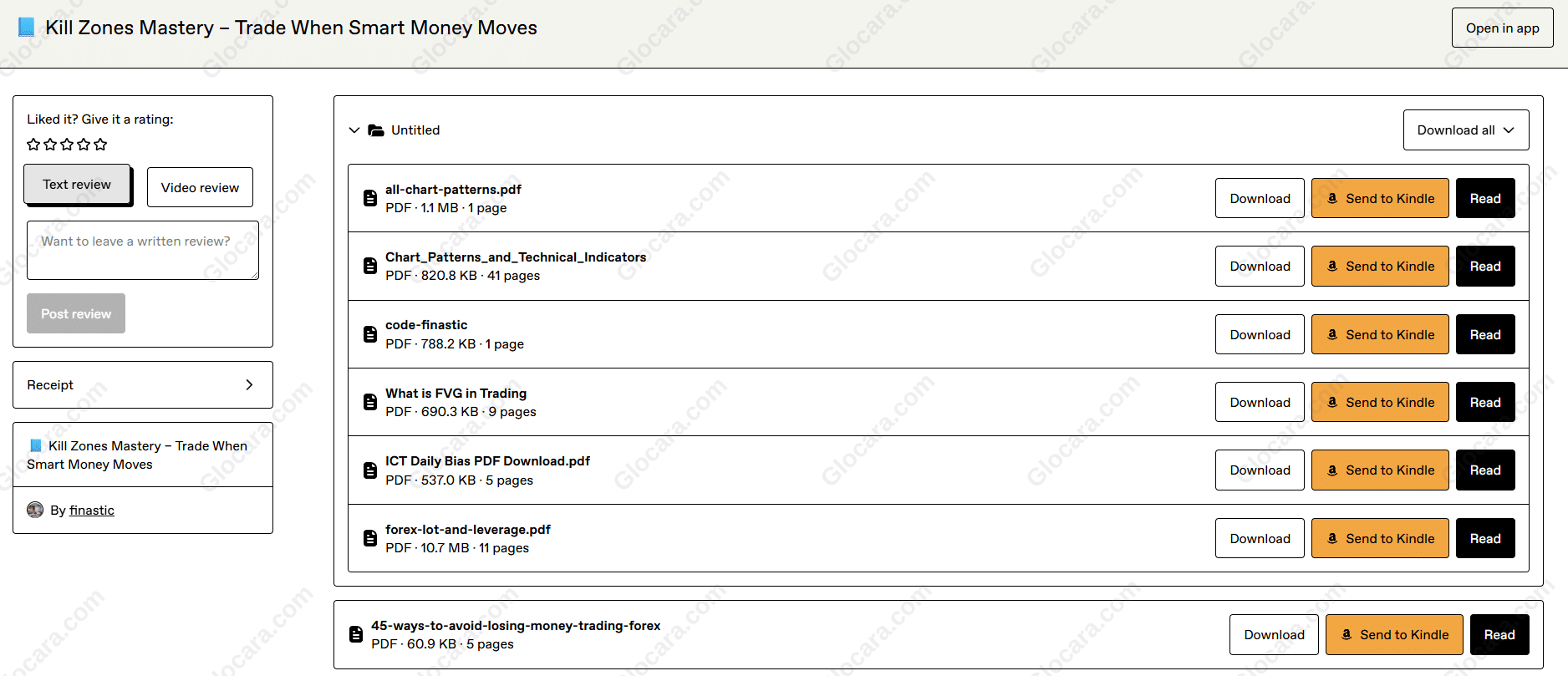

Free Download the Kill Zones Mastery – Trade When Smart Money Moves – Includes Verified Content:

PDF Sample – Kill Zones Mastery – Trade When Smart Money Moves, watch here:

Kill Zones Mastery – Trade When Smart Money Moves – Watch Content Proof here:

Why Timing Beats Everything

In trading, timing is king. You can have the best strategy in the world — but if you’re trading at the wrong time, the market will punish you.

Finastic’s Kill Zones Mastery breaks down how institutional traders exploit liquidity during specific sessions to trigger retail stops before the real move begins.

This guide teaches you to:

-

Recognize “smart money hours” where real volume enters the market.

-

Avoid false breakouts caused by liquidity raids.

-

Align your trades with professional timing cycles.

-

Execute with precision, not emotion.

It’s not about more trades — it’s about better trades.

Inside the Kill Zones Framework

The ebook is designed for traders who want to combine precision with discipline. Every page focuses on actionable, chart-based insights that can immediately improve your execution.

Here’s a breakdown of what you’ll learn:

1. Understanding the Kill Zones

Discover the three institutional trading windows:

-

Asian Kill Zone – Early liquidity buildup and consolidation patterns.

-

London Kill Zone – The session where volatility starts and traps are often set.

-

New York Kill Zone – The powerhouse session where true direction unfolds.

Each window is explained with its unique market behavior, volatility timing, and price manipulation tendencies.

2. Spotting Liquidity Raids & Trap Setups

Learn how smart money hunts stops. Finastic explains how markets often fake a breakout just before reversing — and how to position yourself on the right side of the move.

You’ll identify patterns like:

-

Midnight Open setups.

-

8:30 “News Trap” reversals.

-

Liquidity sweeps before continuation moves.

3. The Psychology of Patience

Most traders fail not because they lack knowledge, but because they lack patience.

You’ll learn how institutional timing requires waiting for price to come to your zone — not chasing setups in random sessions.

4. Real Examples and Case Studies

The guide includes clear visual examples of real setups showing how kill zone traps unfold on live charts.

You’ll see exactly where to enter, where to avoid, and how to manage trades based on liquidity timing.

Why You’ll Love This Guide

Finastic’s Kill Zones Mastery isn’t another theory-heavy trading book — it’s a real-world execution manual written for traders who value precision and control.

Here’s what makes it unique:

✅ No indicators needed – Just session timings and a clean chart.

✅ Focus on liquidity – Learn how price truly moves in relation to volume and stops.

✅ Institutional perspective – Understand how professionals use timing to trap retail traders.

✅ Clear, actionable rules – No fluff, no filler — only practical strategies.

✅ Compact yet powerful – 21 MB of pure trading intelligence.

Whether you trade forex, indices, or commodities, this timing model applies across markets and timeframes.

Who This Guide Is For

This resource is crafted for traders who are ready to take their craft seriously — those who want to stop gambling and start trading systematically.

It’s ideal for:

-

Intermediate traders ready to move beyond indicators and random setups.

-

Advanced traders seeking sharper precision in timing and execution.

-

Scalpers and intraday traders who rely on volatility and liquidity shifts.

-

Swing traders who want to understand daily structure and institutional moves.

If you’ve ever been wicked out before the real trend, this guide will finally explain why it happens — and how to prevent it.

Meet Finastic: The Mind Behind the Method

Finastic is known for developing trading models based on institutional behavior and liquidity principles, focusing on clarity and consistency rather than complexity.

Through years of research and observation, he decoded how large players — banks, hedge funds, and market makers — strategically move price during specific hours to trap retail traders.

His Kill Zones Mastery distills this deep understanding into a straightforward rule-based approach that any serious trader can follow.

Finastic’s philosophy is simple:

“Don’t trade more. Trade when it matters.”

Key Benefits of Learning Kill Zones Timing

By the end of this guide, you’ll have a clear process to identify when markets move with purpose and avoid unnecessary noise.

You’ll learn to:

-

Pinpoint high-probability trading hours.

-

Recognize manipulation zones before they unfold.

-

Avoid false moves and news-based volatility traps.

-

Time entries around institutional volume injections.

-

Trade with calm, precision, and confidence.

This knowledge alone can drastically reduce overtrading, improve win rates, and help you think like smart money instead of fighting against it.

How to Apply What You Learn

The beauty of Kill Zones Mastery lies in its simplicity.

You don’t need indicators, fancy tools, or expensive data feeds — just:

-

A clean chart.

-

Session timing overlays (Asian, London, NY).

-

Patience and observation.

Combine that with the principles taught in the guide, and you’ll immediately notice how much cleaner your entries and exits become.

You’ll stop chasing and start anticipating.

Why Timing Beats Indicators

Indicators lag — timing doesn’t.

Finastic emphasizes that institutional moves are time-based, not indicator-based.

By aligning with specific hours of volatility, you naturally catch moves at their origin, not after they’ve played out.

That’s why professional traders often say:

“It’s not about where — it’s about when.”

Kill Zones Mastery trains your eye to spot those when moments.

Final Thoughts: Trade When Smart Money Moves

Trading success doesn’t come from constant activity — it comes from precision timing.

Kill Zones Mastery – Trade When Smart Money Moves by Finastic gives you the insider’s edge: understanding exactly when markets shift from noise to opportunity.

If you’re tired of being stopped out right before price moves your way, or wasting hours watching charts without clarity, this guide will transform how you view the market.

👉 Get your copy today for just $15.4 and start trading when it truly matters — when smart money moves.

Because consistency isn’t about more trades.

It’s about trading with intent.

Reviews

There are no reviews yet.